Developing a core FinTech e-banking platform for Ibanera

Read how AVAMAE created a web app allowing customers to manage and trade multiple asset types from one single account.

The US and global banking markets are huge and complex. Customers are increasingly sophisticated, too, trading with large portfolios of different assets. Global FinTech firm Ibanera approached AVAMAE to create a simple to use financial services platform designed to elegantly and securely handle the financial and wealth management needs of businesses and entrepreneurs. Our team delivered precisely that.

Technology and security are key to the global banking sector and Ibanera demanded an e-banking solution that is both powerful, secure and unique. Our team worked closely with Ibanera to design and develop next-generation software that is inherently flexible and totally scalable. The FinTech web app we created enables Ibanera customers to easily manage multi-currency deposit accounts, including buying and selling Crypto currency alongside Fiat currency, as well as manage prepaid cards, merchant accounts, transfers and currency exchange. Following its highly successful launch, we are developing a bespoke native app.

Customer functionality

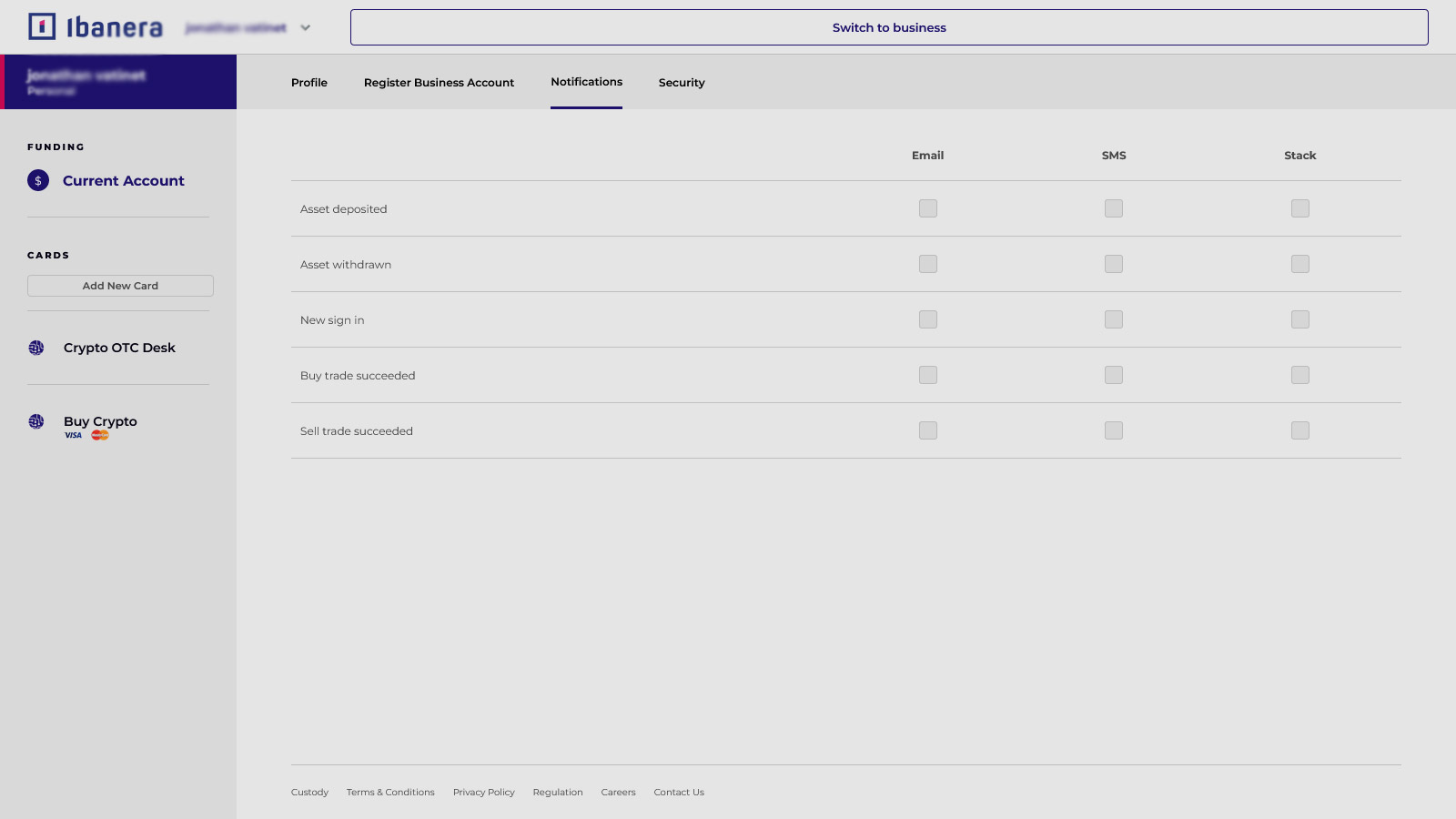

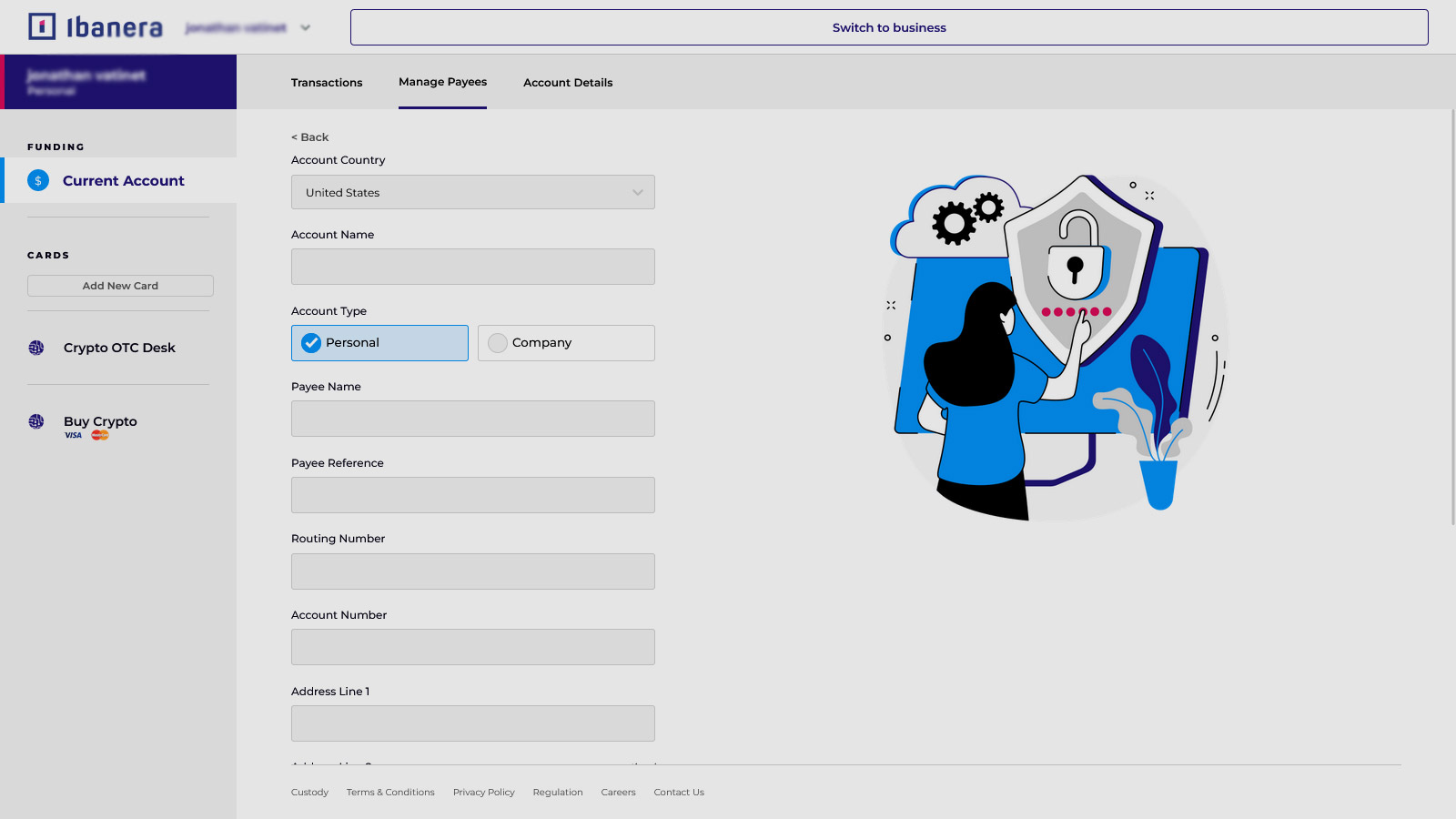

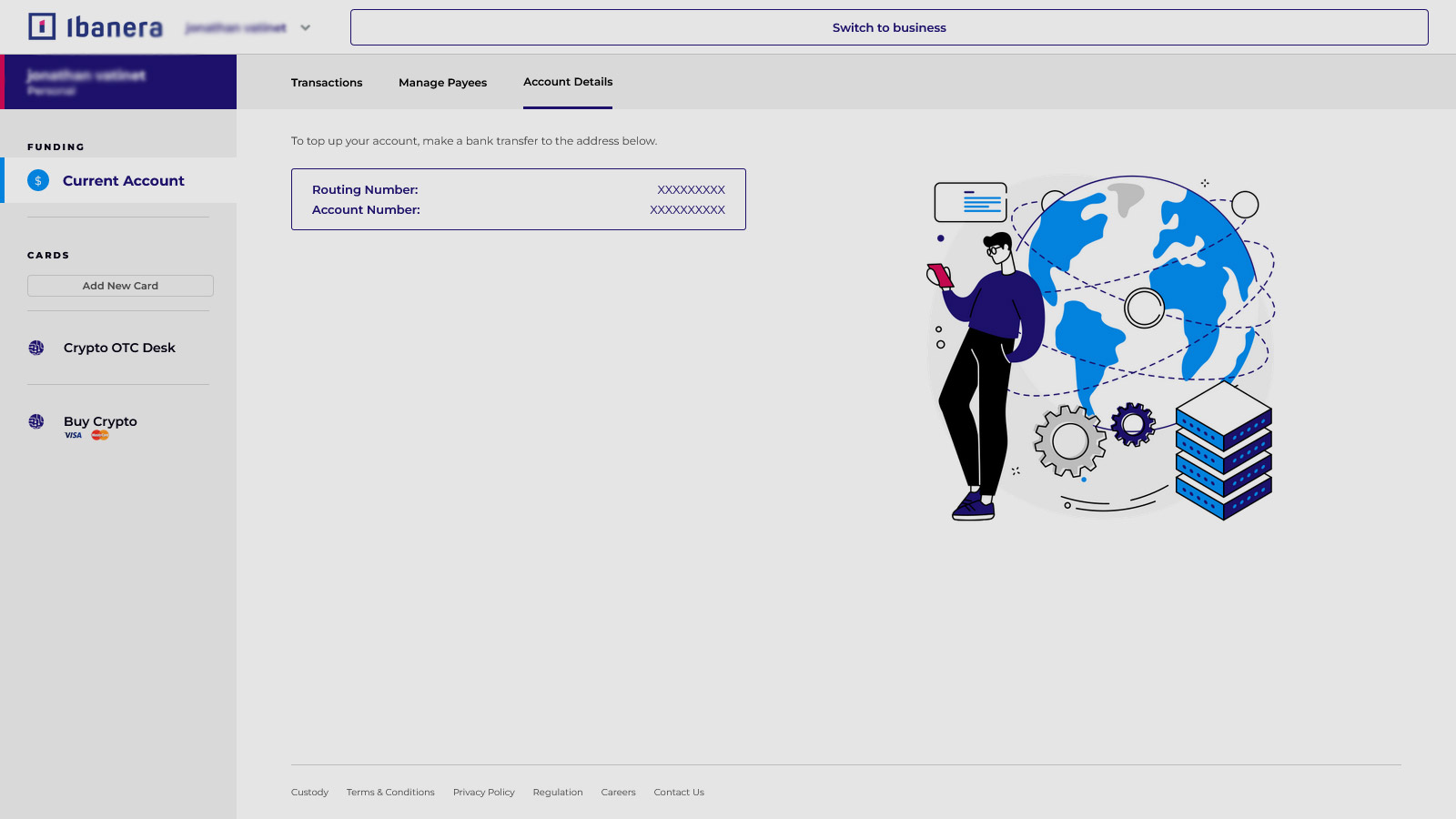

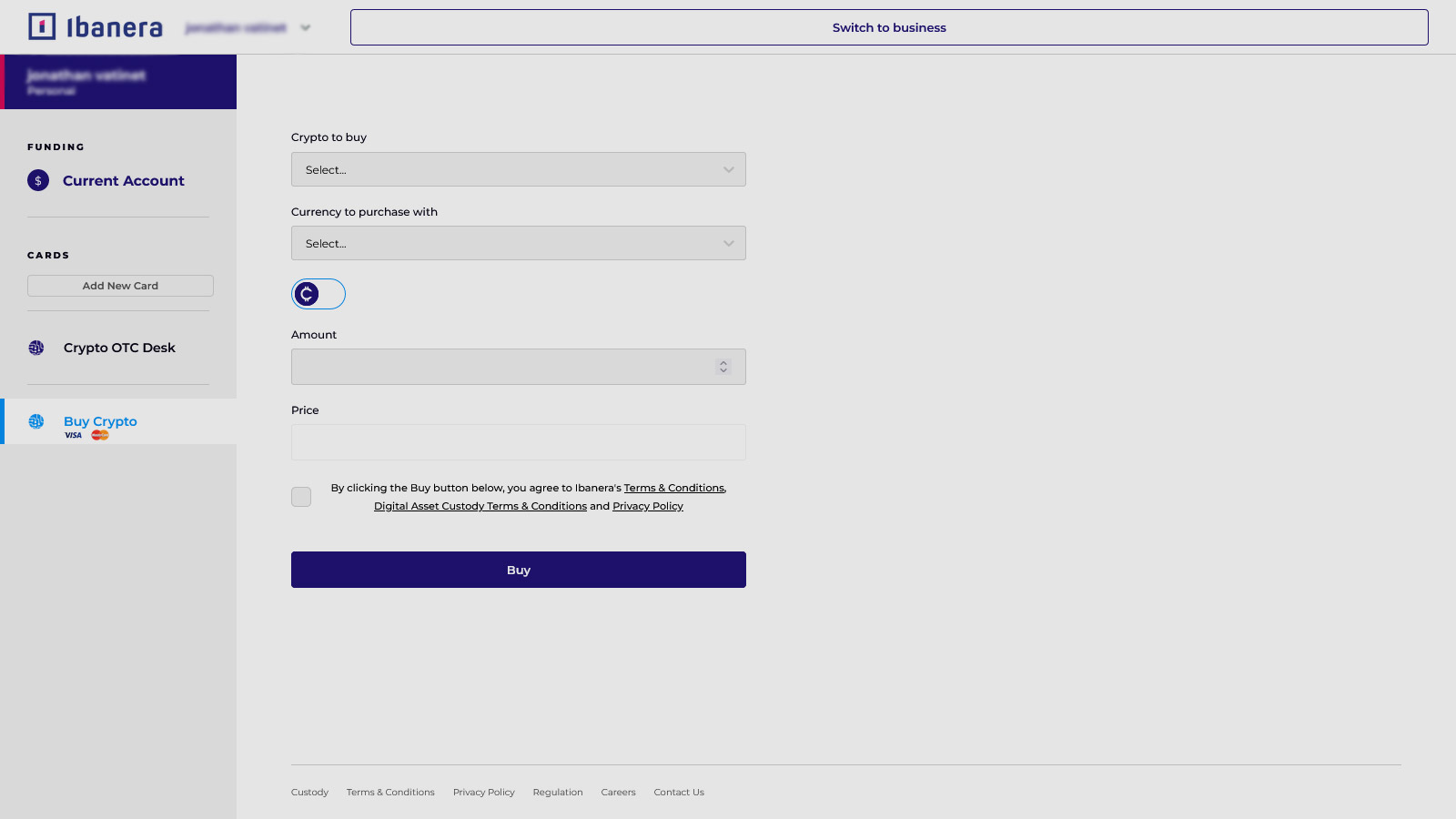

A wealth of features are available to Ibanera’s customers, providing them with a first class online banking solution.

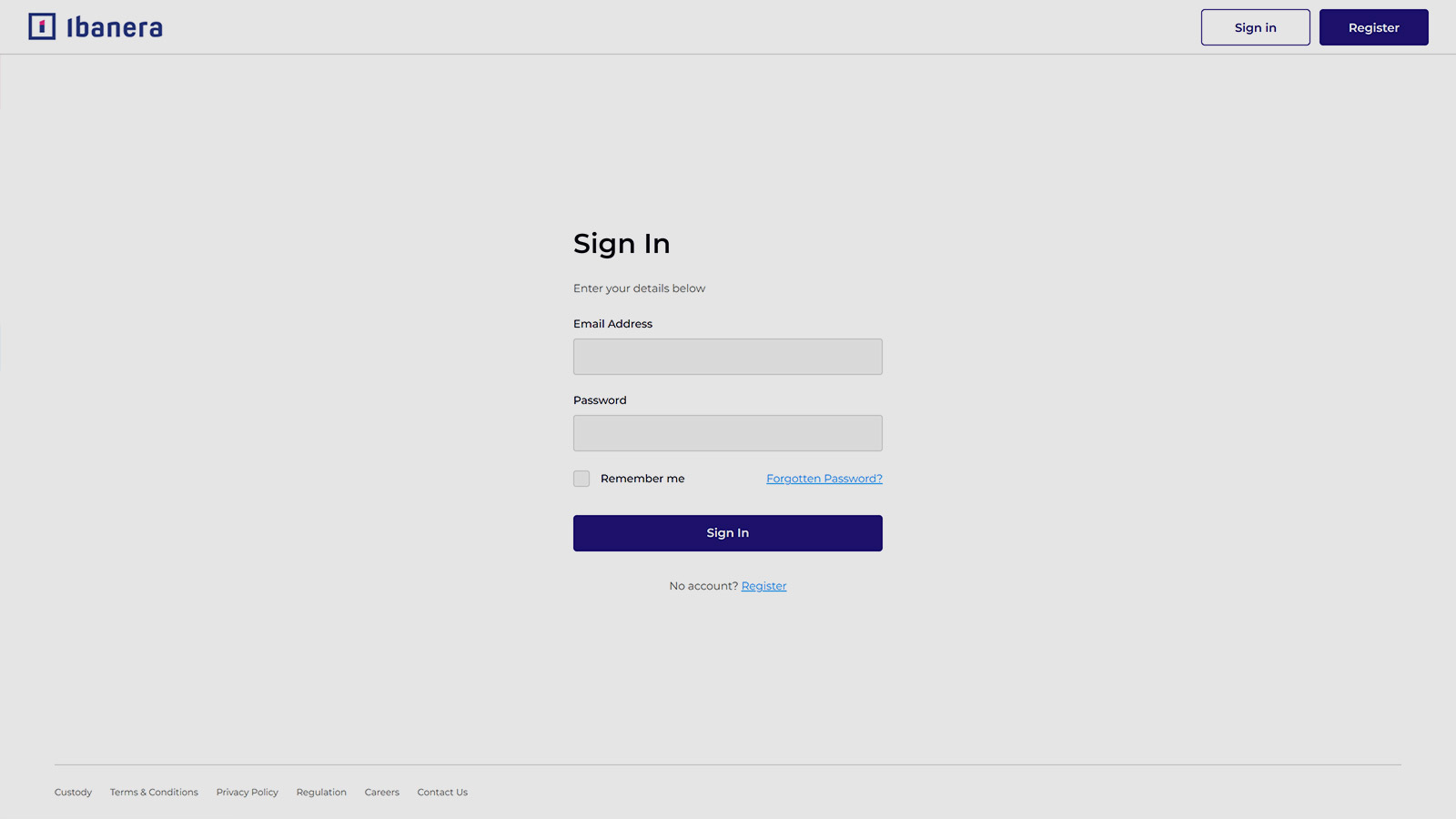

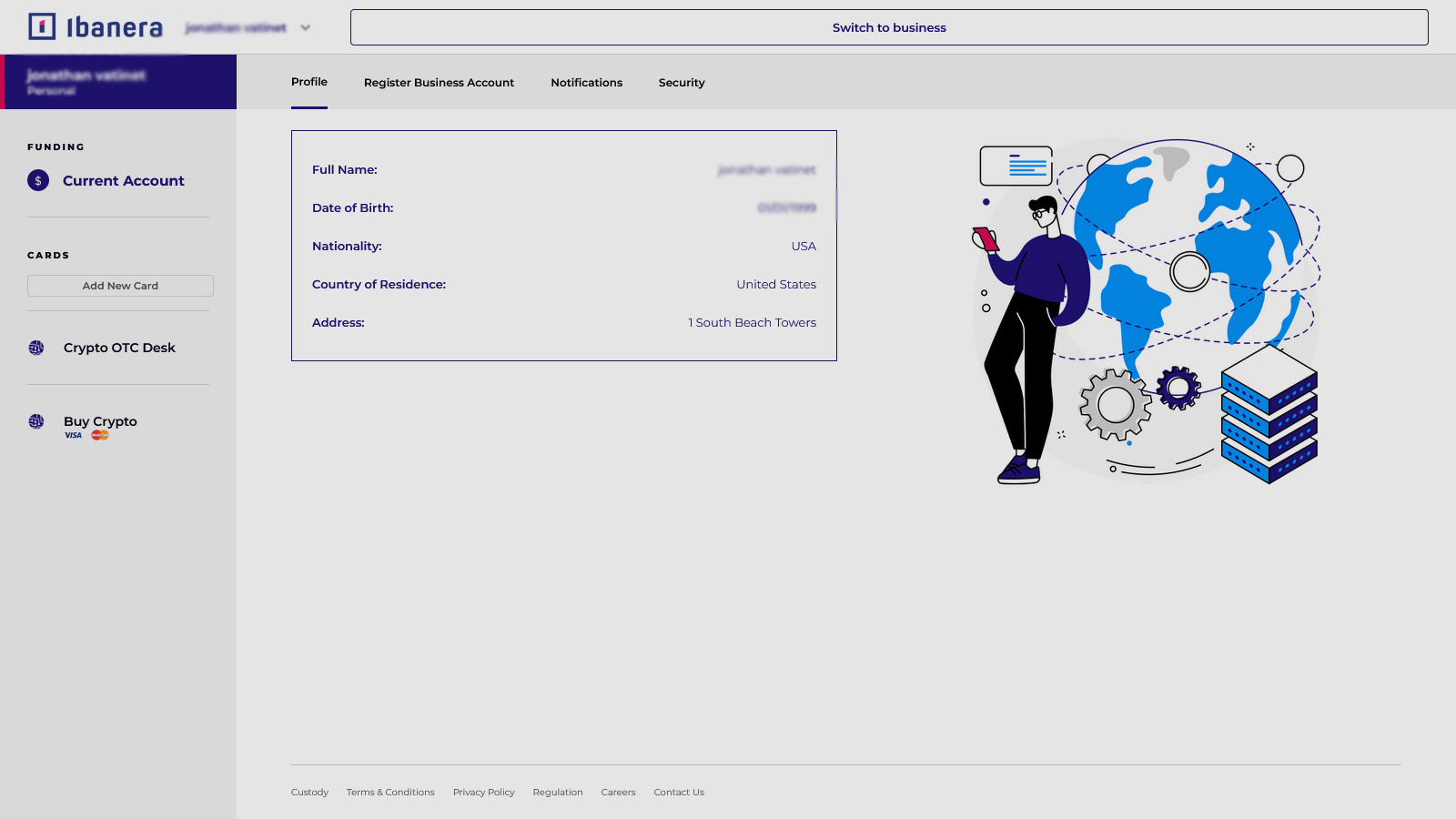

Account Creation – An automated Know Your Customer (KYC) process requires the customer to upload ID and confirmation of address and take a selfie to verify identity. Setting up Multi-Factor Authentication is a compulsory requirement. The highest levels of security are built-in, including device finger printing. Customers can set up both private accounts and business accounts, if required.

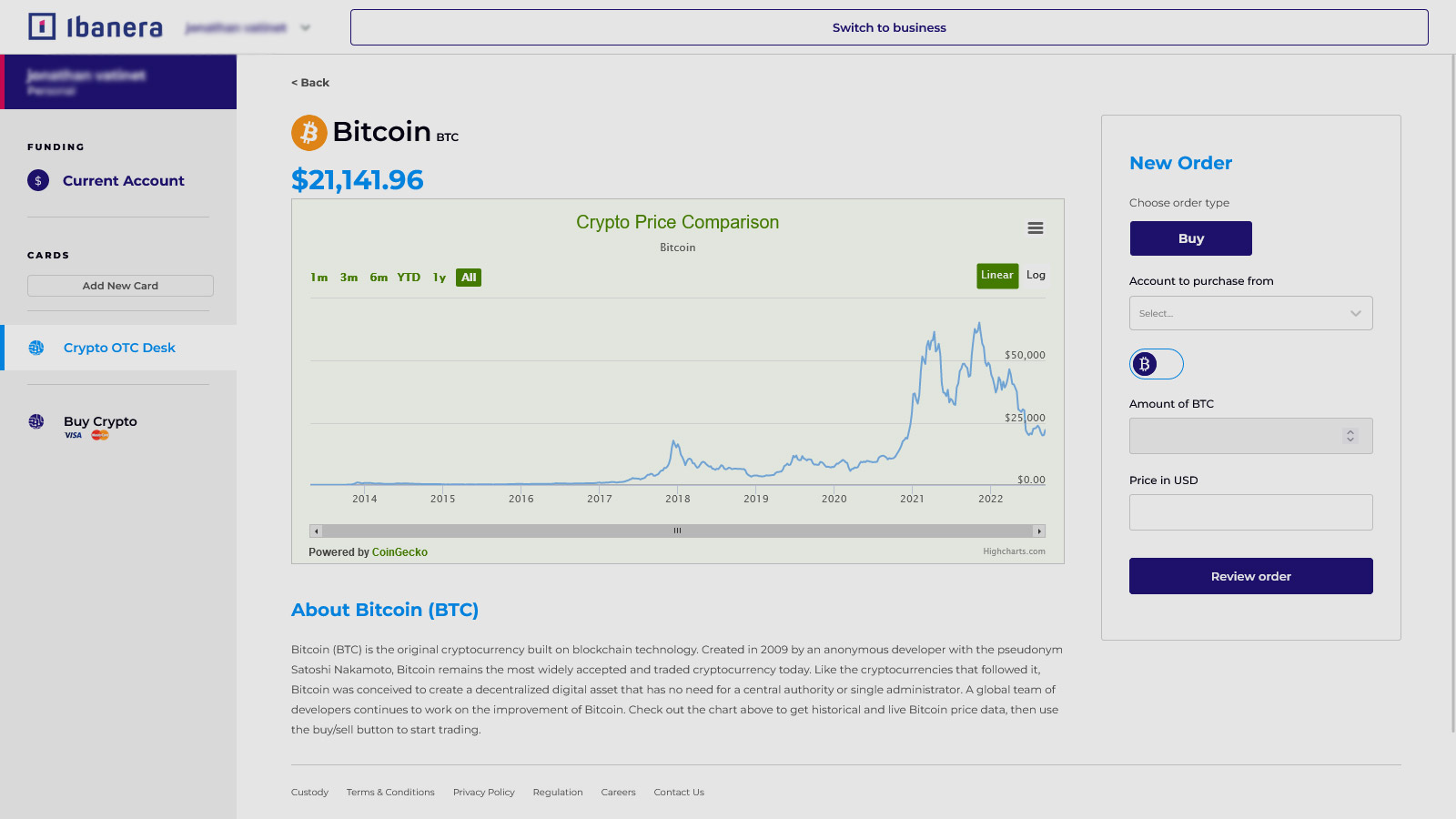

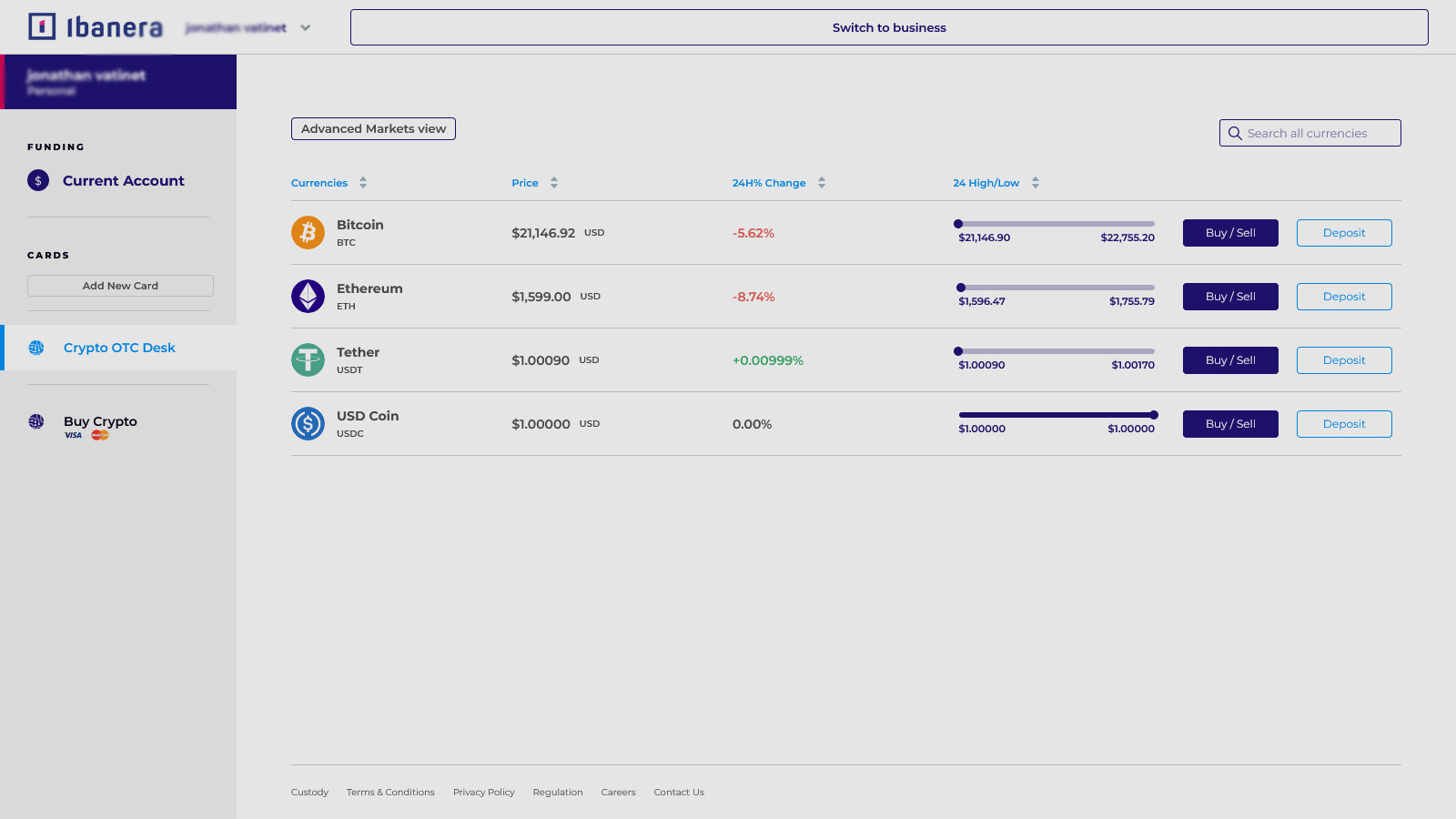

Multiple Ledgers and Asset Classes – Users can have multiple ledgers within their account, with no limit on the number they can add. The platform supports multiple asset classes, including Crypto and Fiat currency, so a user may have one for ledger for US dollars and one for Ethereum, for example. Multiple crypto currencies, including a number of stable coins are supported, as well as multiple fiat currencies.

Currency Wallets – Customers can store their currency in the platform, including secure crypto wallets for storage of crypto currency. They can buy, sell and exchange from one asset class to another, for example buy Ethereum with US dollars or buy US dollars with Bitcoin. They can also transfer any funds in or out of the platform.

Transaction History – The Ibanera app provides all the detailed transaction history you would expect in a standard banking platform, enabling you to search and filter transactions and view the details of these.

Physical Cards – Customers can request a pre-paid payment card to use with their account, and a card management programme allows corporates and others to access functionality that means they can provide cards to teams with funds pre-loaded, as well as top them up when required.

Realtime Market Updates – The Ibanera app provides live market updates and price tracking by asset and asset related news, allowing customers to keep track of the asset types that are of interest to them. Users can also create price alerts for any asset type.

Admin functionality

Sophisticated administrative functionality gives the Ibanera team the oversight that is required to maintain an e-banking platform.

Treasury Functions – A full suite of treasury functions are built into the back end to allow the Ibanera team to smoothly deal with the complexity of managing ledgers.

Admin User Management – Granular access permissions enable the locking down of access by each user, to allow tight control of access to each area of the platform, meaning that no users see anything that is not relevant to their role.

Account Management – Customer and customer account management functions mean that administrators can deal with any customer service issues. Customer access can also be blocked by administrators, should this be required.

Transfers – A clear oversight of all transfers taking place on the platform is available, including automated flags for any potentially suspicious activity recorded by the system. Administrators can then delve into these to investigate further.

Frozen Transactions – Where activity is flagged as suspicious transactions may be automatically frozen. Details of these transactions are available to administrators, along with functionality that allows them to permanently cancel the transaction, or to release it, once the relevant checks have taken place.

Oversight and Management of Operational accounts – Rolling reserves in Ibanera’s operational accounts allow customer transfers to happen in real time. Administrators are able to view information about the rolling reserves and adjust the level of funds available.

Accessing Reports – A full suite of reports allows banking staff to monitor all aspects of the platform.

Integrations

The Ibanera FinTech web app has multiple integrations to boost its core functionality and enhance security processes. These include integrations which carry out the Know Your Customer (KYC) checks, check for blacklisted or sanctioned crypto wallets, anti-money laundering tech, a crypto currency exchange, and the secure vaulting of crypto currency. Pre-paid cards are issued via an integration with a third party financial institution, and emails and other comms facilitated through an integration with major comms platforms.

APIs, Whitelabel and Widgets

To extend the reach and access of Ibanera, a “Quickbuy” crypto widget can also be embedded on third party sites, allowing users to buy currency instantly.

APIs are also available for Banking-as-a-Service (BaaS) clients. Integrating Ibanera’s white label digital banking software enables partners to create their own customised financial products.